The options trading landscape has undergone a significant transformation in recent years, driven by the increasing participation of retail investors. Once dominated by institutional traders, the options market is now experiencing record trading volumes, heightened volatility, and evolving market dynamics, thanks to the rise of retail investors. This shift is largely attributed to the accessibility of commission-free trading platforms, the proliferation of online trading communities, and the influence of social media on market sentiment.

In this article, we will explore the role of retail investors in shaping the options market, discuss their impact on liquidity and volatility, and analyze how institutional traders are adapting to this evolving market environment. We will also answer some of the most frequently asked questions regarding retail trading in the options market and showcase a Trading Tutorial designed by TradeVision to help you improve your trading strategies.

The Rise of Retail Investors in Options Trading

Retail trading has surged in popularity over the past few years, with a significant increase in individual participation in the options market. Several key factors have contributed to this growth:

- Commission-Free Trading – Platforms such as Robinhood, Webull, and E-Trade have removed barriers to entry by offering commission-free trades, allowing retail traders to participate without incurring high costs.

- Access to Market Information – The internet has made it easier for retail traders to learn about option trading. YouTube, Twitter, Reddit (r/wallstreetbets), and Discord groups have become essential resources for new traders looking to understand market trends and trading strategies.

- Increased Risk Appetite – Many retail traders are willing to take on high-risk trades with the hope of generating quick profits. The rise of zero-day-to-expiration (0DTE) options has fueled this speculative trading behavior.

- Social Media Influence – Viral trends in trading, such as the GameStop (GME) short squeeze and AMC’s retail-driven rally, have showcased how collective retail action can disrupt market norms.

- High Market Volatility – Economic uncertainty, geopolitical tensions, and inflation concerns have contributed to greater market volatility, attracting traders who thrive in fast-moving markets.

The Impact on Market Liquidity and Volatility

With the influx of retail traders, the options market has witnessed increased liquidity and volatility. While greater participation is generally seen as a positive development, it has also led to unpredictable market swings. Here’s how retail investors have influenced key market elements:

1. Increased Liquidity

Retail investors contribute significantly to trading volume, particularly in short-term options. The high turnover of contracts results in greater market liquidity, which can lead to tighter bid-ask spreads and smoother trade execution.

2. Amplified Volatility

Retail-driven trading can create sudden price spikes and dips, as seen in meme stock rallies. This increased volatility presents opportunities for traders but also heightens market risks, making price movements more unpredictable.

3. The Rise of Short-Term Options Trading

One of the most significant trends in retail trading is the rise of short-dated options, especially 0DTE contracts. These contracts expire the same day they are purchased and have seen a surge in popularity due to their potential for quick gains. However, they also carry a high risk of total loss.

4. Challenges for Institutional Traders

Institutional traders, who rely on quantitative models to predict price movements, have had to adapt to the increased noise created by retail trading activity. Many institutions are incorporating retail sentiment analysis into their strategies to better anticipate market movements.

Adapting to the New Market Landscape

With retail traders playing a more prominent role in the options market, both individual and institutional participants must adjust their strategies to thrive in this evolving environment.

1. Retail Traders: Managing Risk and Avoiding Speculation

- Focus on Risk Management: Given the inherent risks of short-term options trading, retail traders should prioritize risk management strategies, such as stop-loss orders and portfolio diversification.

- Understand Market Trends: Retail traders should remain informed about economic indicators, Federal Reserve policies, and earnings reports that influence options prices.

- Avoid Herd Mentality: While social media can provide useful insights, traders should conduct their own analysis rather than blindly following trends.

2. Institutional Traders: Leveraging Retail Sentiment

- Retail Sentiment Analysis: Institutions are increasingly using AI-driven tools to monitor retail trading behavior and identify potential market trends.

- Options Pricing Adjustments: Institutions have modified their pricing models to account for the unpredictability introduced by retail-driven price swings.

- Liquidity Management: Market makers are adjusting their hedging strategies to accommodate the increased demand for short-term options.

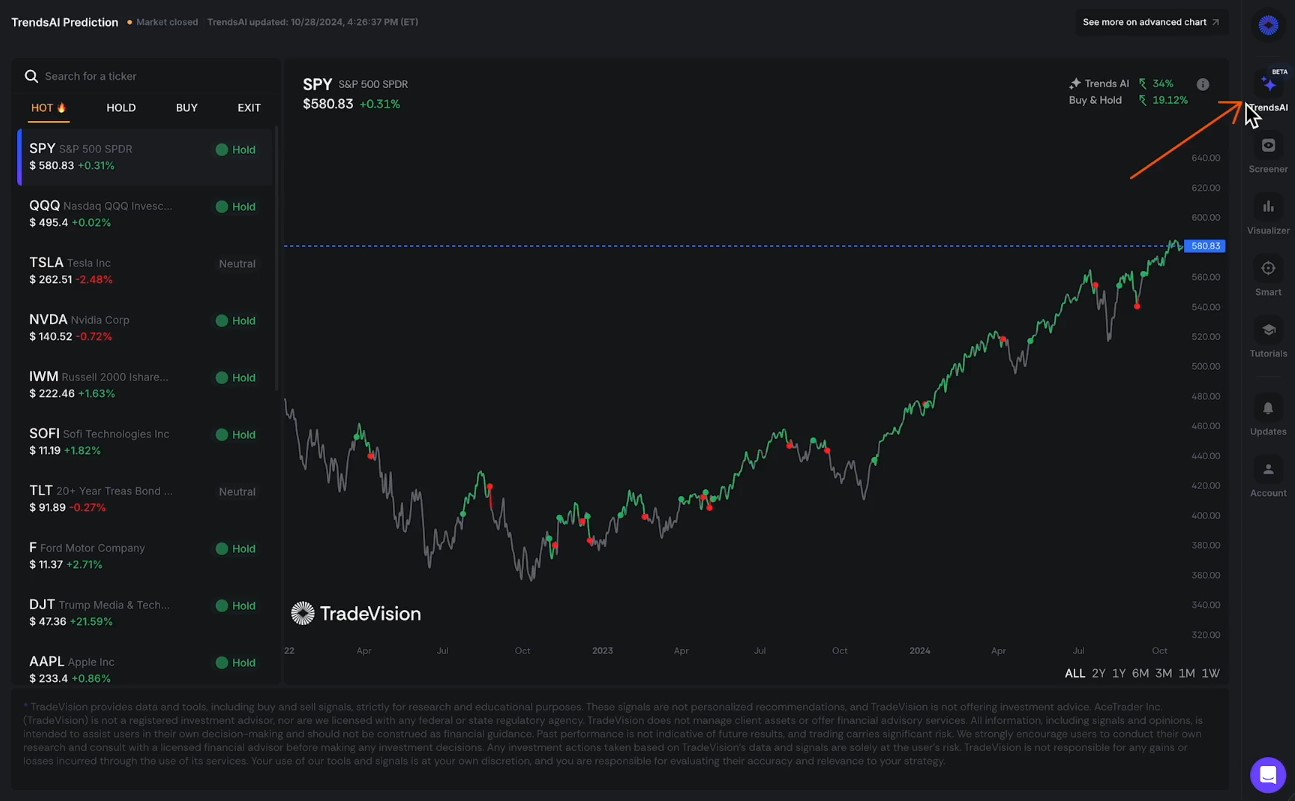

TradeVision’s Trading Tutorial for Option Traders

To assist option traders in improving their trading strategies, TradeVision has created an in-depth Trading Tutorial. This tutorial is designed to help traders of all experience levels understand market behavior, technical analysis, and effective strategies for options trading. Whether you’re a beginner or an experienced trader, the TradeVision Trading Tutorial offers valuable resources and guidance to enhance your trading skills.

Key components of the tutorial include:

- Understanding Market Fundamentals: An introduction to the core concepts of options trading, including calls, puts, strikes, and expiration dates.

- Risk Management Strategies: How to manage risk in your options trades with techniques such as setting stop-loss orders and position sizing.

- Advanced Trading Strategies: A deeper dive into more complex strategies like spreads, straddles, and iron condors to help traders profit in both bullish and bearish markets.

- Trading Psychology: Techniques for managing emotions and maintaining discipline while trading in volatile markets.

- Real-World Case Studies: Practical examples to help traders visualize and apply different strategies to live market situations.

The TradeVision Tutorial is an excellent tool for any option trader looking to refine their trading skills and navigate the complexities of the options market with confidence.

Frequently Asked Questions (FAQ)

1. Why have retail traders become so influential in the options market?

Retail traders now have greater access to commission-free platforms, real-time market data, and online trading communities. Their collective activity, especially in short-term options, has amplified their market impact.

2. What risks do retail investors face when trading options?

Options trading carries inherent risks, particularly for inexperienced traders. The high leverage of options can lead to substantial gains but also significant losses. Short-term options, such as 0DTE contracts, can expire worthless within hours.

3. How do retail traders influence market volatility?

Retail traders often engage in speculative trading strategies, leading to sudden price movements. Their participation in short-dated options, as well as coordinated trading actions, contributes to increased volatility.

4. What are 0DTE options, and why are they so popular?

0DTE (zero-day-to-expiration) options are contracts that expire the same day they are traded. They have gained popularity due to their low cost and potential for high returns. However, they are also extremely risky due to their short lifespan.

5. How can retail traders protect themselves from significant losses?

Retail traders should use risk management strategies, such as setting stop-loss orders, avoiding excessive leverage, and diversifying their portfolios. It’s also important to have a clear trading plan rather than relying solely on social media trends.

6. How do institutional traders respond to the rise of retail investors?

Institutions are incorporating retail sentiment analysis into their trading models and adjusting their hedging strategies to manage the unpredictability caused by retail-driven trading patterns.

Conclusion

Retail investors have significantly reshaped the option trading landscape, bringing increased liquidity, heightened volatility, and new market trends. While their participation presents both opportunities and challenges, it is clear that retail traders are now a force to be reckoned with in the financial markets.

For retail traders, managing risk and staying informed about market developments is crucial. Meanwhile, institutional investors must adapt to the new trading environment by leveraging retail sentiment analysis and modifying their strategies accordingly.

As options trading continues to evolve, one thing is certain: retail investors are here to stay, and their influence on the market will only grow in the years to come.