We’re thrilled to introduce Smart Money Trades, a powerful new tool that gives you unparalleled insights into the world of institutional trading. Whether you’re an experienced investor or just starting out, understanding what the big players like banks and hedge funds are doing can provide a significant advantage in your trading strategy. Let’s dive into what Smart Money Trades offers, how you can benefit from it, and how to use this tool effectively.

What Are Smart Money Trades?

At its core, Smart Money Trades helps you track the trading activities of large institutions. These players often conduct their trades in secretive environments, such as dark pools—private exchanges that obscure their actions. With our platform, you gain access to this valuable data, allowing you to see:

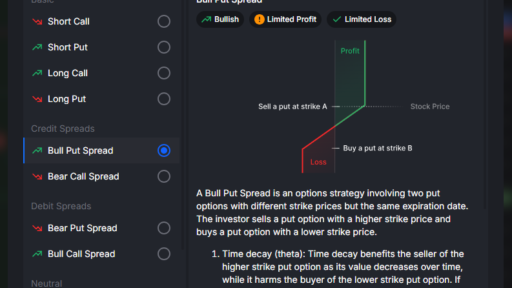

- Block Trades: Large trades that can indicate significant market movements.

- Trade Type: Whether trades are bullish or bearish, offering insights into market sentiment.

- Profit Potential: An analysis of the likelihood of these trades being successful.

By understanding institutional activities, you can make more informed decisions about your investments.

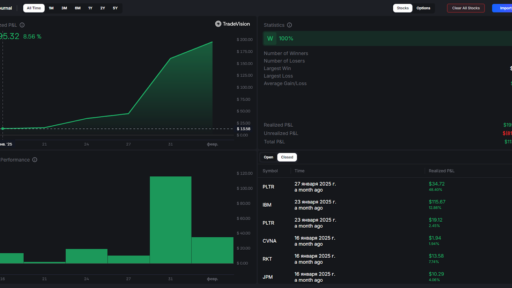

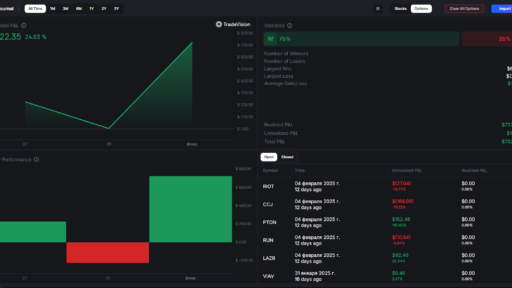

How to Use Smart Money Trades to Your Advantage

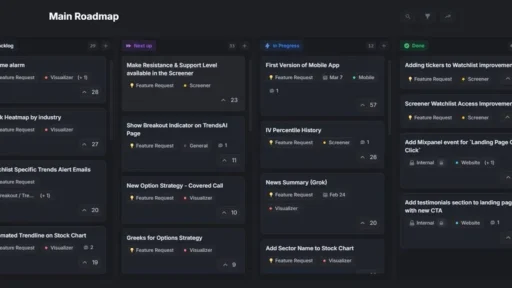

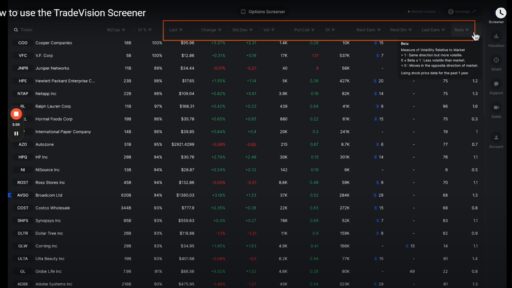

1. Explore the Dashboard

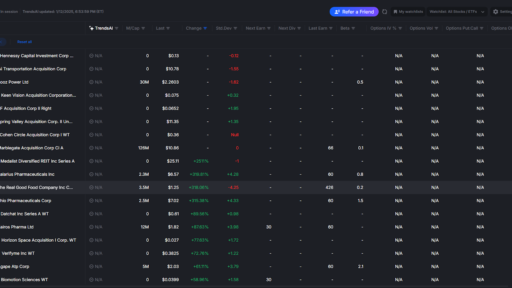

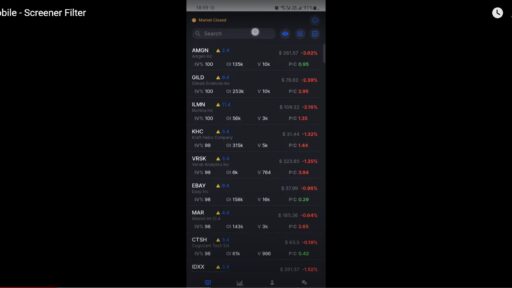

Upon logging in, you’ll see a user-friendly dashboard displaying essential information such as:

- Ticker Symbols: The stocks or ETFs you’re interested in.

- Trade Expiration: When the trades are set to mature.

- Trade Details: The nature of the trade (bullish or bearish), stock price at trade initiation, strike price, and total investment.

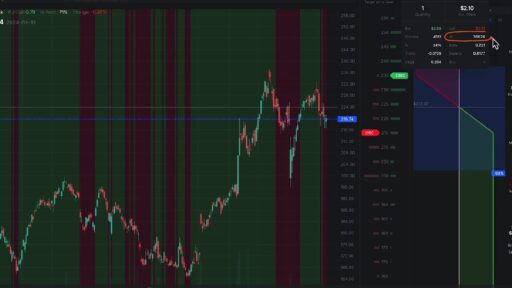

2. Analyze Unusual Trades

One of the most significant features is the ability to identify unusual trades. By comparing the size of a trade to the average open interest for that ticker, you can gauge its significance. For example, if you notice a $1.1 million trade that stands out against typical volumes, it might be worth investigating further.

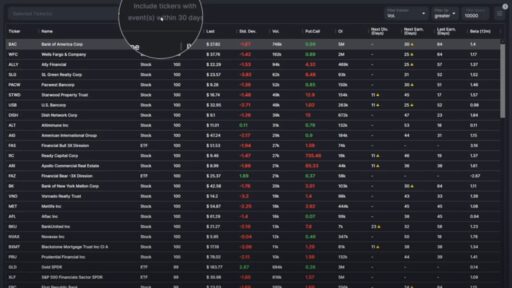

3. Filter for Insights

The platform offers various filters to refine your search:

- Safe Bets: Focus on trades with a high probability of profit (e.g., 95%+).

- Most Unusual Trades: Identify large trades that diverge from the norm.

- Top Position Sales: Look for significant premium trades, both spent and received.

- Long Shots: Explore trades with low probabilities of success—sometimes these can reveal unique opportunities.

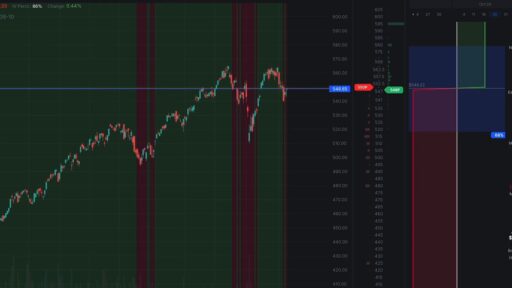

4. Stay Updated with Live Data

The Smart Money Trades platform updates in real-time. Make it a habit to check daily for fresh insights that could inform your trading decisions. This allows you to react promptly to market changes and capitalize on new trends.

5. Research Specific Stocks

If you have a particular stock in mind—like Tesla—simply type its ticker into the search bar. You can sort the results by trade size, allowing you to quickly identify significant institutional activity. For instance, if you see two massive call options worth $57 million and $56 million, it signals bullish sentiment that could influence your own trading strategy.

Conclusion: Empower Your Trading Decisions

Smart Money Trades is designed to empower you with knowledge and insights that can enhance your trading strategy. By following institutional movements and analyzing trade data, you can position yourself better in the market.